Friday, 22 September 2023

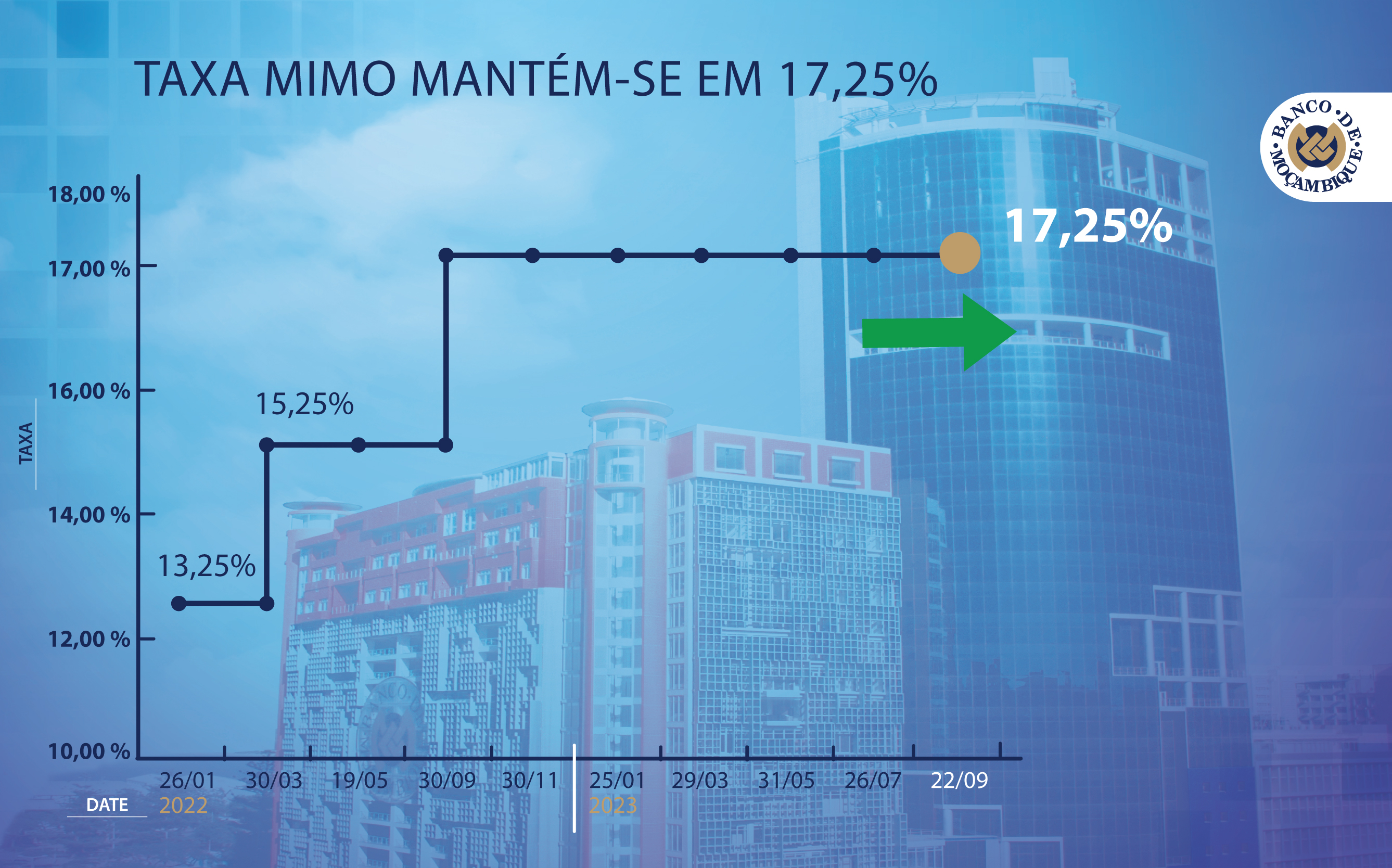

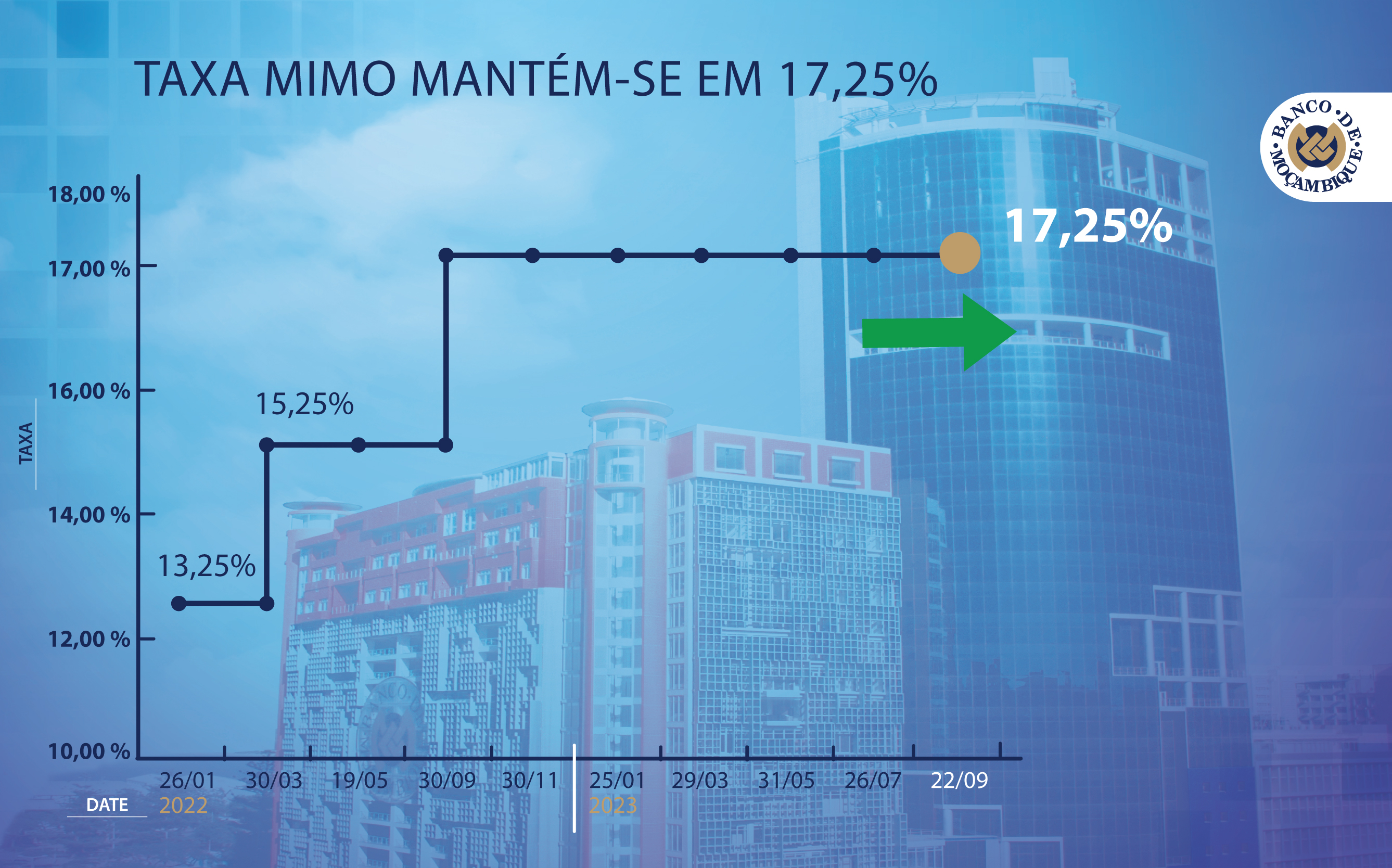

MIMO POLICY RATE UNCHANGED AT 17.25 %

The Monetary Policy Committee (MPC) of the Banco de Moçambique has decided to keep the MIMO policy rate unchanged at 17.25%.

Friday, 22 September 2023

The Monetary Policy Committee (MPC) of the Banco de Moçambique has decided to keep the MIMO policy rate unchanged at 17.25%.

Friday, 22 September 2023

The shareholders and creditors of Africâmbios, Lda. are invited to review its accounts and draft the remarks concerned.

Wednesday, 20 September 2023

Today, September 20, 2023, the Banco de Moçambique Museum opens to the public.

Friday, 08 September 2023

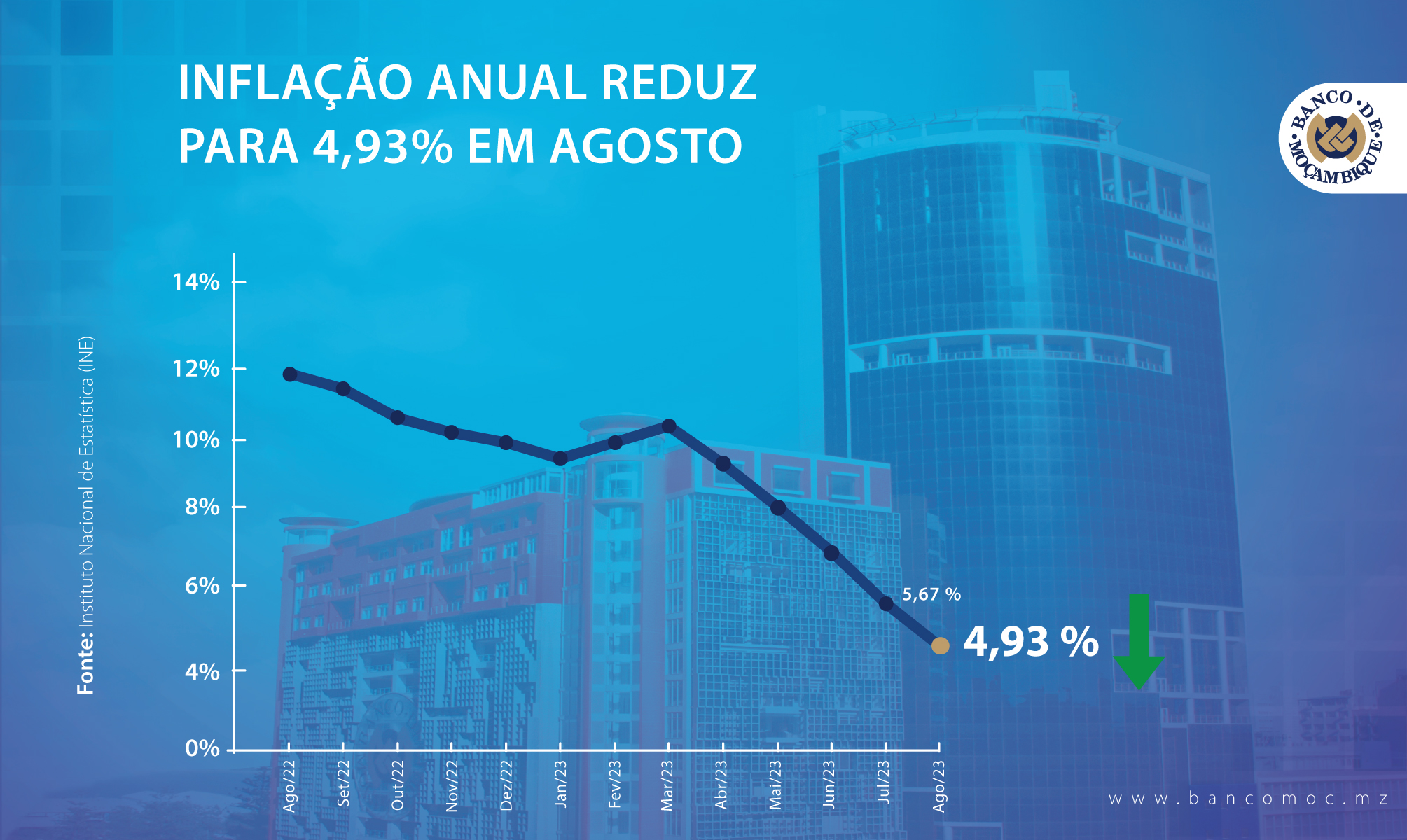

The reduction in annual inflation remains explained by the favorable behavior of food prices and the stability of fuel prices.

Wednesday, 06 September 2023

Today, the Governor of the Banco de Moçambique delivered an inaugural lecture of the doctoral program in Development Studies.